It’s an irony, but a curable one, that CPAs and EAs have tremendous advantages over traditional financial advisors, yet capture less than 10% of their clients’ wallet share. Rather than allowing overcomable barriers to entry block them, tax professionals should focus instead on the many ways they can help their clients succeed.

Success is something a tax pro’s clients badly need. According to the consulting firm DALBAR, the average American equity fund investor has significantly underperformed the S&P 500 year in and year out. In 2021, that underperformance was over 10%, and between 1987 and 2016, a remarkable 30-year period for the U.S., the average investor underperformed by 7.6% per year.

This was a tremendous failure, not only for the American family, but by the financial services industry. A passive investment of $100,000 made on January 1, 1987 would have grown to $1,842,671 by the end of 2016. However, the 2.6% average return investors actually earned would have grown to only $215,984 (if in a qualified account).

The entire American enterprise would be better off if average American investors could do better. And the tax professionals who add wealth management advisory services to their tax compliance business would help themselves enormously by helping their clients invest the way family offices do.

This is no far-fetched idea. I can’t imagine a family office anywhere in the Western world that does not have one or more tax professionals in leadership positions. The owners of family offices, who are the wealthiest families in their countries, can have anything they want, and overwhelmingly they choose the family office model.

I believe that the family office model will democratize, and I suggest that the perfect person to lead that trend is the tax professional. I also suggest that the least perfect person would be a salesperson. Family offices don’t need or want any selling; what they want is a true fiduciary to structure and implement a sophisticated portfolio driven by a single goal: the family’s best interests.

Here are eight reasons why the tax pro is ideally suited to take on the role of Family Office Director:

CPAs Get The Order Of Decision-Making Right

The proper order of decision-making in wealth management is taxes first, then math. Of course the billionaire class is terribly concerned about taxes, and notably estate taxes. But every American family would like to pay less tax on their income and on their capital gains.

If a billionaire pays out hundreds of millions in taxes, they’re still very rich. But the millionaire next door will feel the bite in a much more meaningful way. I live in California, and if I am lucky enough to experience a seven figure short term gain, I will keep less than half of it. Even a long term gain will incur a big tax hit.

In family offices, investment policy is downstream from tax policy. Enabling tax avoidance strategies is largely a function of structuring, and that should happen before any consideration of which specific financial products should be used. When we do have the structure right, the decision about how to select the ideal financial solutions should be entirely objective, transparent, and meritocratic.

Does any of that sound like the way financial product salespeople operate? Of course it doesn’t; the incentives that drive salespeople typically put the salesperson’s interests first.

Tax Professionals Focus Only on Those Things That Can Be Controlled

Tax pros focus on controllables and ignore the things they cannot predict or control. This can be extraordinarily difficult in the noisy world of financial product sales. Grounded in financial statements and control, tax pros consider the hard data: what things cost (and the value they derive), tax efficiency, risk control and overall risk exposure.

A tax pro is naturally going to have a hard time putting a value on predictions, which, by their nature, will rely on luck and not skill. I cannot think of a single person who has been able consistently to predict market movement, volatility, correlation, economic activity, world events, legislative impact, climate change or any other future event.

Tax pros inherently understand that get-rich-quick schemes usually end in getting poorer. Investing requires patience and discipline, and no financial professional I can imagine has more of those two key ingredients than tax professionals.

Collaboration Comes Naturally to Tax Professionals

The tax pro who works in a corporate environment as a CFO or controller understands their role as a team player. They don’t run sales, or operations, or manufacturing, and they appreciate that those are mission-critical activities.

A family office needs multiple subject matter experts from across the financial services spectrum. This includes tax strategy, asset management, risk analysis, estate planning, portfolio allocation, compliance, legal and client servicing. What makes family offices so effective, and so attractive to their owners, is the cooperation and coordination among all these professionals.

The benefits of this coordination are hugely significant. It eliminates professional bias as well as fee layering. It provides for superior decision making, and acts to catch concentration risks. The collaboration works to create “best of” solutions. For me personally, I would always want my tax professional to assure me that important decisions had been carefully considered.

Financial Analysis Is A Core Skill of the CPA

In a monument to understatement, let me say this: accountants are comfortable with financial statements. This alone gives the tax professional a huge advantage. Investing decisions are financial decisions. Do you know an insurance salesperson who truly understands depreciation? Does anyone in your non-accounting professional network actually understand tax compliance or tax strategy?

I’m guessing you get asked general financial questions all the time. Here’s a radical suggestion: why not get paid for that advice? Your clients ask you these questions for two distinct reasons. One is that they believe you will know the answer, and two, they believe in your integrity. They trust you because of the combination of those two things.

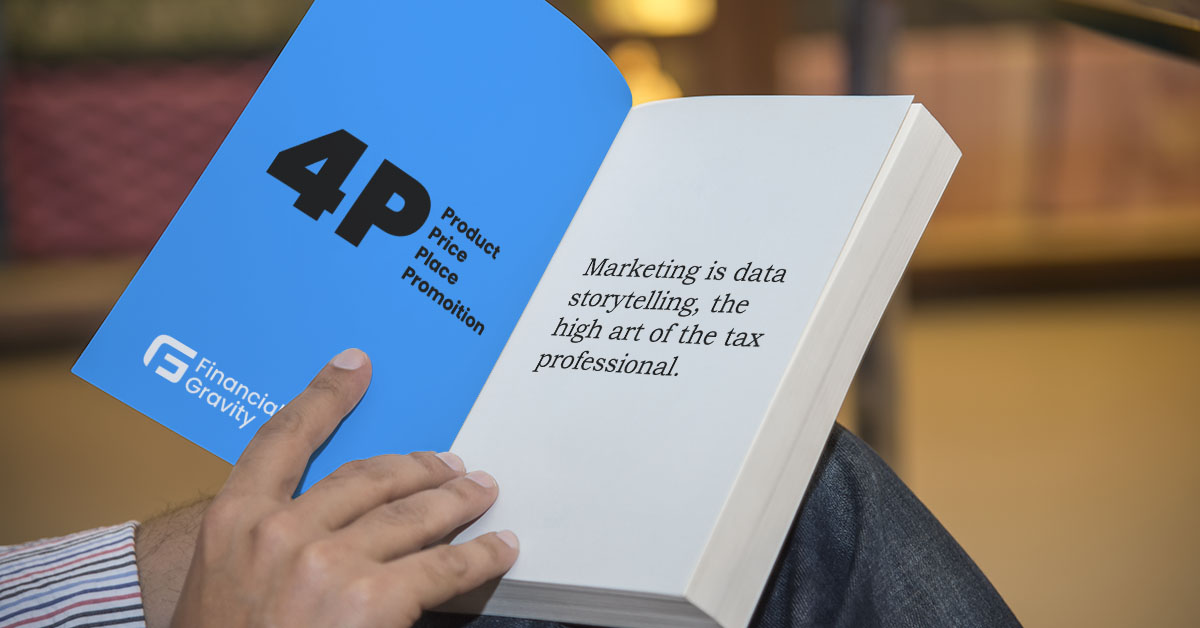

Tax Pros Are Skilled in Data Storytelling

Data storytelling is essentially the application of your familiarity with financial statements and managerial accounting. This is a specialized skill that only highly trained professionals possess, yet which clients prize. Making arcane subjects approachable is a key to gaining the client’s buy-in on strategy.

Data storytelling can be thought of as the opposite of selling. Data, by their nature, are simply facts, just decision inputs. Even the term “decision inputs” is a term of art for tax pros, and likely never uttered by a salesperson. Which do you suppose produces a better outcome, decisions driven by data or by persuasion?

Tax Pros Are True Fiduciaries

This one stands alone, and by itself tilts the board in favor of the tax pro. It’s difficult to imagine anyone preferring to work with someone who stands to gain no matter the outcome to them, when they could instead choose to work with someone whose only goal is their client’s best interests.

The term fiduciary is wildly overused in the marketplace. Many who claim to be one don’t actually know what it means. In a family office there is no confusion, no conflict, no question about the incentives. It’s the perfect environment for a tax pro. And it’s the single best way to reach the optimal outcome for the client.

Tax Pros Have Far Better Training, Credentials, and Experience

Fee-based financial advisors need to pass the Series 65, the Uniform Investment Adviser Law Examination. I won’t even cover what broker dealer representatives must pass, because broker dealers operate under the “suitability standard”, which is by definition not a fiduciary standard. The idea of a CPA or EA working for commissions on securities is just too strange.

The 65 has 130 questions, and candidates must get at least 72.3%, or 94 of them, right to pass. There are background checks and bonding requirements, but compared with what a CPA has to do, it’s a very low bar. No college degree. No CPA Exam. No one year vetting period. No nights auditing dusty books and records. Compared with a tax pro, not much at all.

If we accept that family offices are the ultimate delivery platform for client success, consider that, to my knowledge, zero of them hire directors without significant training, credentials, and experience. Take a moment and think about what this difference could mean for your client. Whom do you think they would rather get advice from? You know the answer. Enough said about that.

CPAs Don’t Sell To; They Buy For

Perhaps the biggest single advantage tax professionals have over financial advisors, and a trait that in some ways includes all seven other advantages, is that they invert the century-long practice of hiring salespeople to push insurance and financial products. Instead of selling things to their clients, tax professionals advise on the ideal solutions; they buy for, not sell to. Again, just ask yourself: which approach would you prefer for your family, your parents, your loved ones?

Tax professionals that don’t work in family offices generally stay away from advising on matters of wealth and risk management not just because they don’t wish to become salespeople. They simply don’t know how to acquire the knowledge, develop the infrastructure, or create the marketing platform they need to get into the business.

The great news is that there are multi-family office outsourcing companies that understand the power of the tax professional as a Family Office Director. CPAs and EAs would be wise to look into this option. It could be game-changing for their income, productivity and valuation, but it could be life-changing for their clients.

My company, Financial Gravity, offers a pathway for tax pros serving ordinary American families to add multi-family office services to their clients with our Turnkey Multi-Family Office Charter. You can find out more at www.financialgravity.com. There is an on-demand webinar, blog library, access to our Tax Master Network, and my new book, Winning the Wallet Share War. The book is free, and is available in audiobook, e-book, hard copy and interactive web version.