How did a funny-looking slave from ancient Greece acquire his freedom and earn immortality? By finding wisdom all around him. For thousands of years after his death, schoolchildren the world over have been introduced to Aesop, whose cautionary tales provide insight into the human condition, largely through anthropomorphic animals.

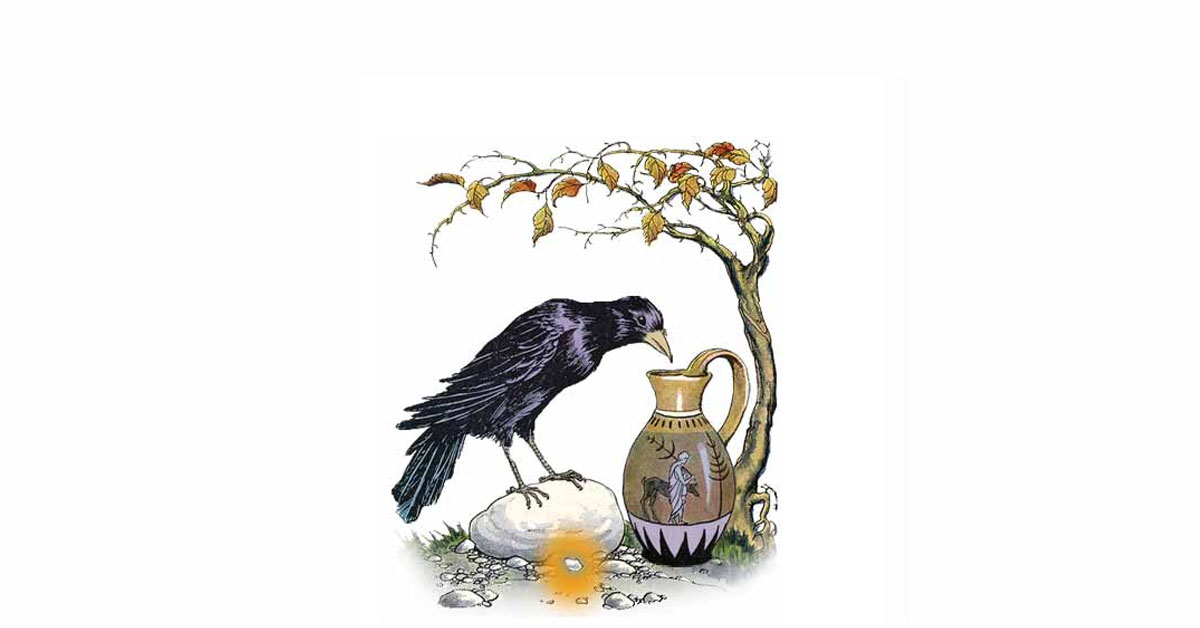

Tax professionals who seek to grow their businesses without selling—which in my experience, is almost all of them—would be wise to consider Aesop’s fable about the crow and the pitcher. A thirsty crow happens upon a pitcher with unreachable water at the bottom. The crow tries to push the pitcher over, but it’s too heavy. The clever crow then drops pebbles into the pitcher one by one, eventually causing the displaced water to rise to within reach of his beak.

It seems to me that the crow’s strategy is exactly the right approach for the CPA or EA who wishes to grow their business. You won’t succeed by pushing prospective clients over; as a salesperson might. Rather, you will need to build credibility and awareness pebble by pebble until these prospects come to realize that your wisdom and character are the right traits to help guide them to financial success.

As I have blogged before, and discussed at length in my book Winning the Wallet Share War, accountants are ideally suited by training and personality for a career as advisor. With their grounding in financial statements and math, and their fact-based approach to problem-solving, they make wonderful Family Office Directors. It can’t be proved, but I’d assert that every family office has at least one tax professional in a key client-facing role.

CPAs and Eas Have Amazing Pebbles to Drop

That ultra-wealthy family that employs the tax pro understands the critical importance of forward-looking tax strategy—hence the tax expertise’s inherent value. Franklin’s admonition that nothing is certain but death and taxes is the defining reality of an organization dealing with massive amounts of money across multiple generations. But it’s also true that millions of American families would benefit from tax planning and a long-term approach to wealth management, and all of them would also benefit from the advice of a CPA or Enrolled Agent.

Tax avoidance strategies work best in a coordinated environment where professionals across the spectrum of finance work together to solve clients’ problems. Estate, asset, and risk management operate best when everyone on the team is focused solely on the best interests of their clients. And the benefit for the tax pro should not be overlooked: increasing the scope of their services can profoundly impact revenues, productivity, and practice valuation.

Let’s say that the client family is the pitcher in Aesop’s fable and that the water is their spending on financial solutions and advice. What pebbles can the tax pro drop into the pitcher to claim a well-deserved share of that water? I suggest they are bits of wisdom that will educate the client on how to be a better consumer of financial services.

The tax pro who can provide a regular flow of useful and valuable information is doing their clients, and themselves, a huge favor. Unlike those mega-rich families that can afford their own family office, the mass affluent and the millionaires next door live in a world largely free of true fiduciaries, and the incentive structures of the industry promote siloed decision-making. This explains why the average American equity investor so badly underperforms the benchmarks year after year.

Five Simple Rules To Master Marketing for Tax Pros

You know a great deal about taxes, money, finance, and the mistakes that lead to failure. But you sit on the sidelines, far from that pitcher of water. Why? Well, because marketing is hard, and it takes infrastructure. Establishing and maintaining contact with people who will help you grow your business is not trivial. At a minimum, you’ll need a customer (or client) relationship management platform or CRM. The CRM is where you’ll maintain the contact information of the folks you’re trying to communicate with. It’s also where you will be able to see the entire history of your relationship…every email, phone call, newsletter, invitation, bill, tax return, and every other contact, whether inbound or outbound. That’s powerful stuff; you must have it if you want to get that water level up.

There are a lot of CRM platforms on the market, and they run the cost gamut from very small money to thousands of dollars per year. It’s great to scope your communications plan before selecting a CRM vendor. Some offer the power you’ll never need or want. Some require expensive consultants to help you get set up, while others are intuitive and quick to learn.

Whatever CRM platform you decide upon, it will only have value if used with discipline. Generally speaking, your CRM application should always be open on your PC or workstation. And you will want to keep your contact files current, adding new contacts and deleting old ones.

Deciding which clients or influencers get which communications is a critical task. I’d suggest that the most important cohort is your existing clients, for the simple reason that they have the most potential and are the easiest to reach. They know you, and you’ll enjoy very high open rates on the material you send them.

What you send is a massively consequential decision. In my experience, clients of tax pros get confused when they sense that they are being sold something. I’d suggest you always make sure to ground your communications in your tax work. For example, you can talk about the importance of qualified retirement accounts, and give examples like the venture capitalist who put early-stage capital stock in his Roth IRA when it was virtually worthless, only to see it become worth billions. Taxes first, than potential benefits, is a great way to extend your credibility.

Conceiving and creating educational material can be a daunting task. This is why we see so many CPA websites that have a “Library” page with only a few articles attached, and long gaps in between. In tax season, it’s inconceivable for most tax experts to carve out the hours they would need to write up a quality email, newsletter or blog. This is why most tax pros simply don’t communicate at all, unless it’s one-on-one and task-oriented.

In my experience, as a person who writes a monthly newsletter that’s delivered to many thousands of tax professionals’ clients, you are likely to find that marketing is a full-time job. After all, I don’t do tax compliance work. It’s a rare person who can do both well.

Tax pros who communicate with their clients have deeper and more meaningful relationships, and they create the opportunity to provide more services, such as asset and risk management advice. These revenue lines come with many benefits: they provide revenues all year long, tend to be high margins and create higher business valuation multiples.

Here are a few tips for the tax pro seeking to deepen their relationships, increase their income and, eventually, sell their practice for much more than it’s worth now:

Tip 1: Never sell anything

Provide useful information, stories, and practical tips on how to multiply the tax savings you’ve provided. All too often, there’s a breakdown between your strategies and the insurance and financial planning people the client hires to implement them. Offer to stay involved and ensure the integrity of the people and processes they work with. If you’re not ready now, plan to evolve your business model to one where you actively direct the work. That’s when the revenues start to double.

Tip 2: Have something of value to offer

It’s easy to point out that most people have no idea how much money they’re spending for financial products and advice, but it takes on real meaning when you offer to discover the answer on their behalf as part of your service. Or demonstrate how location optimization and loss harvesting can create hundreds of thousands of new, after-tax dollars.

Tip 3: Outsource to a tax-adjacent marketing firm

Too many marketing companies try to create content that is applicable to any professional, and, therefore, ineffective for all of them. Stick with the taxes first angle. It’s who you are, and what you do, and how you can add the most value.

Tip 4: Brand everything

All communications from you should “look like you.” Your typeface, fonts, images, styles, logo, brand, website, emails, contact information, and everything, should reflect your brand values. If you haven’t already taken the time to create a branding guide, do so before beginning your outreach campaign. Every pebble you drop needs to be yours.

Tip 5: Don’t give up

It may take years for a client to have that “aha” moment they think of you as their problem-solving go-to expert. Commit to a lifetime of communication. Coca-Cola is still spending many millions every year to support a brand that was created in 1886 and sells 1.8 billion beverage servings per day.

These are essential rules for creating an effective communications strategy, but never selling and never quitting are the most important of all. You’re going to want and need to outsource this effort, and your new partner had better appreciate the importance of the tax professional for it to work, but if you find that partner and commit, you have a reasonable expectation that very good things are about to happen.

My firm, Financial Gravity, offers a Turnkey Multi-Family Office Charter that includes agency-level marketing solutions consistent with the rules outlined above. You can learn more about this by watching a short on-demand webinar, The Multi-Family Office Difference. You can also book a call.