Series Preface:

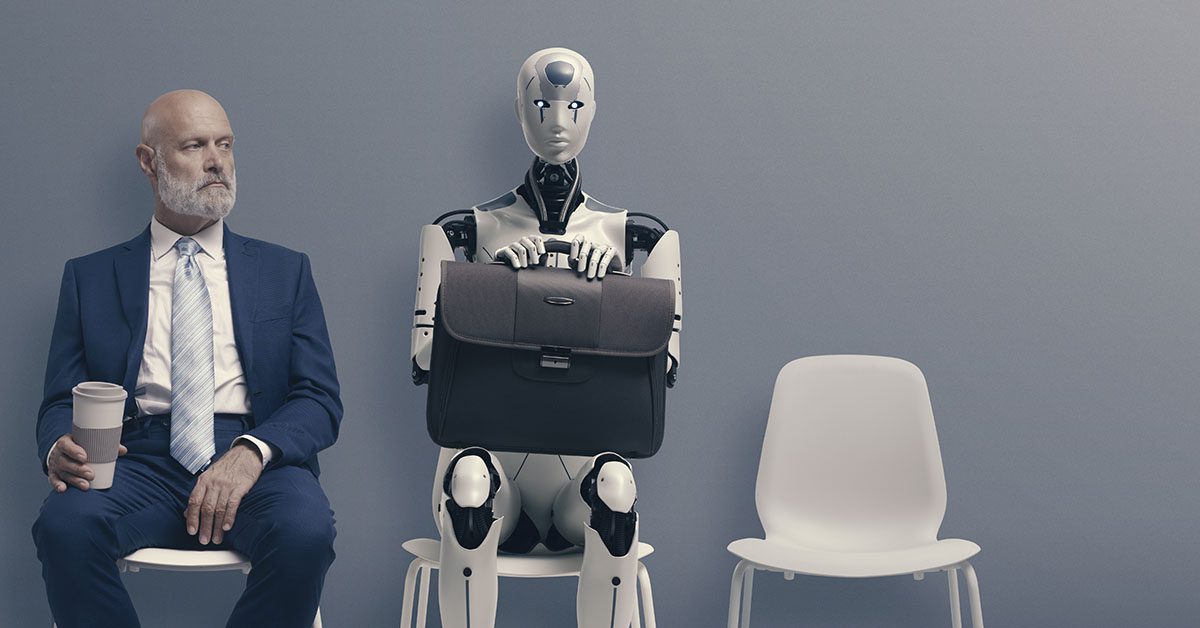

The Robots Are Coming is a multi-part series by Scott Winters that explores how artificial intelligence is reshaping the role of financial advisors. From humanoid avatars to intelligent automation, each article breaks down the threats, tools, and transformations that will define the next decade—and the advisors who survive it.

Ten years from now, your day won’t begin with an alarm clock—it’ll begin with your neural interface gently nudging you awake, syncing your brainwaves to a curated morning routine. Your smart home—now an adaptive ecosystem of AI-driven microservices—will already have optimized your circadian lighting, brewed your nootropic-infused coffee, and projected a holographic news brief tailored to your emotional state. Meanwhile, your Tesla Optimus humanoid, affectionately named “Carl,” will have completed his early shift: walking your AI-collared dog, trimming your vertical garden, self-diagnosing and repairing the HVAC nanogrid, and sending a termination notice to the now-redundant pest control drone service. All of that will have happened before your eyelids even open.

Carl doesn’t sleep, doesn’t call in sick, and doesn’t text “running late” because he doesn’t run—he glides. In my house alone, he’ll replace the gardener, housekeeper, handyman, HVAC guy, pest control tech, window washer, and yes, even the dog poop picker-upper. Carl is competent, quiet, tireless—and disturbingly polite. Which, frankly, only makes him more unsettling. And that’s just the beginning.

Zoom out. A few months ago, Bill Gates predicted that in the age of AI, only three jobs are truly safe: coders, energy experts, and biologists. That’s it. People who can teach the machines, power the machines, or understand the life forms the machines can’t yet replicate. Notice what’s not on that list? You guessed it—financial advisor.

Why? Because in the brave new world we’re barreling toward, being a fiduciary isn’t a superpower anymore—it’s a baseline requirement coded into the bots. AI won’t push a high-commission product just to hit quota or pad its payday. It won’t gloss over fees, miscalculate a Roth conversion, or take a long weekend after a tough quarter. It won’t have a bad day, a sales target, or a hidden agenda. It’ll just deliver objective, conflict-free advice—24/7, for a fraction of your fee—and with a perfect memory and infinite patience.

And we’re not talking about glorified chatbots. Your clients won’t just get a blinking cursor in a chat window with decent insights. They’ll interact with a humanoid avatar that looks and speaks like a TED Talk version of you—measured tone, empathetic pauses, camera-ready charisma, and a memory so flawless it makes your CRM look like it was scribbled on a napkin.

If you’re still shrugging this off as science fiction, I’ve got news for you: you’re already behind. Don’t take my word for it. Go to www.tavus.io and spend five minutes talking to a humanoid avatar that responds, persuades, and mimics human conversation with chilling precision. It’s not clunky. It’s not cartoonish. It’s polished, persuasive—and frankly, a little unnerving. The future isn’t coming. It’s already here. And it might just knock your socks off.

Oh—and unlike you? It’ll be backed by the collective intelligence of human history, update itself in real time, and charge pennies per hour.

Let that settle in for a moment.

So here’s the real question every advisor should be asking: How will you compete in a world where AI can do everything you do—faster, better, and cheaper?

Because while Carl is out restaining your fence, “Finbot”—your AI-powered doppelgänger—might be in your client’s living room, explaining tax-loss harvesting and estate planning strategies with last night’s market movements baked into the conversation. Finbot won’t forget what happened in 2018. It won’t mix up the spouse’s name. It won’t suggest a strategy that contradicts a client’s long-standing goals. It’ll deliver it all—slick, seamless, and creepily on brand.

This isn’t just innovation. It’s an existential threat.

But here’s the upside: disruption doesn’t destroy everyone. It rewards the prepared. While many advisors will get steamrolled, the savvy ones will evolve. Because even in a world run by algorithms, there are still a few things that can’t be automated.

First, stop being a walking calculator. Portfolio construction? Allocation models? That’s just table stakes now. Your value has to move upmarket—into coaching, into planning, into the emotional work of translating complexity into confidence.

Be more human, not more technical. AI can analyze data, but it can’t look a widow in the eye. It can’t help a client navigate the fear of retiring when the math says they can, but their gut says “not yet.” Empathy, judgment, and real-world experience still matter—and they’re hard to code.

In a world drowning in data, become the curator, not the creator. Your clients don’t need more information—they need someone to filter the noise, connect the dots, and tell them what it all means.

And don’t fight AI—use it. The enemy of your business can also be your secret weapon. Let AI handle the reports, the workflows, the prep emails, and the personalization touches you never had time for. Let it amplify your humanity, not compete with it.

Finally, double down on trust equity. People don’t fire advisors they trust. They don’t replace relationships that feel real. Your bond with clients—your presence in their lives during hard decisions and harder seasons—isn’t something a machine can replicate. Not yet, anyway.

Yes, this future is thrilling. And terrifying. But remember—Blockbuster didn’t die because Netflix was better. It died because it refused to evolve.

This article kicks off The Robots Are Coming, a multi-part series exploring how financial advisors can not only survive but thrive in the age of intelligent machines. We’ll dig into the tools, practice models, and mental shifts that will set you apart while the unprepared get swept away.

So check back next week. Carl might be re-grouting your shower tiles, but you’ve got a business to future-proof.